The magic rule of venture capital says that you need to screen 1000 companies to find 2 that are successful. How much time and effort an investor puts in his quest of the Holy Grail? And how much more into creating a proper dealflow?

A LOT.

It is simply called Dealflow Management and it’s the second main activity of investors, after fundraising. The dealflow management doesn’t have the best reputation, thus analysts and interns are usually the ones in charge. In fact, their main job is to provide “good dealflow”. In translation this is the equivalent of hours spent doing Excel sheets, powerpoint presentations for the next Partner meeting, writing minutes, updating databases, asking for documents and metrics to companies, preparing reports for management and LPs, etc…

However, the good news is that most of it can be automated with deal flow management software. In this article we are going to share some tips and tricks on how to improve your current approach to dealflow. If you are new to dealflow management, following these steps will help you manage change and efficiency in your organization.

Step 1: Think clearly about your process

In order to do that, think about one company in which you invested that made you proud of how you handled the relationship. Then write down the different stages of evolution and the main activities you performed. For example, these stages can be:

- new deal source

- first meeting

- partner meeting

- terms and agreement

- due diligence

- rejected/invested

Then work with a software venture capital tool that is flexible enough to support your process. Or a better version of your process.

You always want to learn how other investors manage their dealflow. An easy way to find out is to ask a sales provider of dealflow solutions during the demo “what are the best practices in the industry?/do you have customers in similar organizations, how do they organize their dealflow?”. Good sales people are trained to teach you in order to commit to their solution. If a sales person starts pitching his product before learning about your needs you might be in the wrong place.

Step 2: Execute your deal origination strategy

How did you get the best leads in the past?

The most popular and by far the most powerful strategy for deal origination is the network approach. The best venture capitalists have extensive networks and influence. If you share your knowledge people will appreciate it and will want to share something in exchange. At Edda we work with funds that manage assets between 3M$ and 1.3B$. What makes the difference between a very big fund and a small fund is how they leverage their network to create value. Recently we have created a specific tool for one of our biggest customers in New York. Their initial request was: create more transparency with LPs and ecosystem by sharing data from the dealflow. I will tell you more about that in a future article, I don’t want to disclose too much before the product will be launched later this month.

Online deal origination should not be neglected. Sources like Crunchbase, Pitchbook, CB Insights or TechCrunch to name just a few are great sources to learn about new trends. Consider also following your influencers on twitter, linkedin and medium. I personally enjoy reading @Fabrice Grinda blog. He shares raw stories from his life and business with a touch of humour. I even borrowed his technique of writing emails to a future self to deal with difficult choices or doubts.

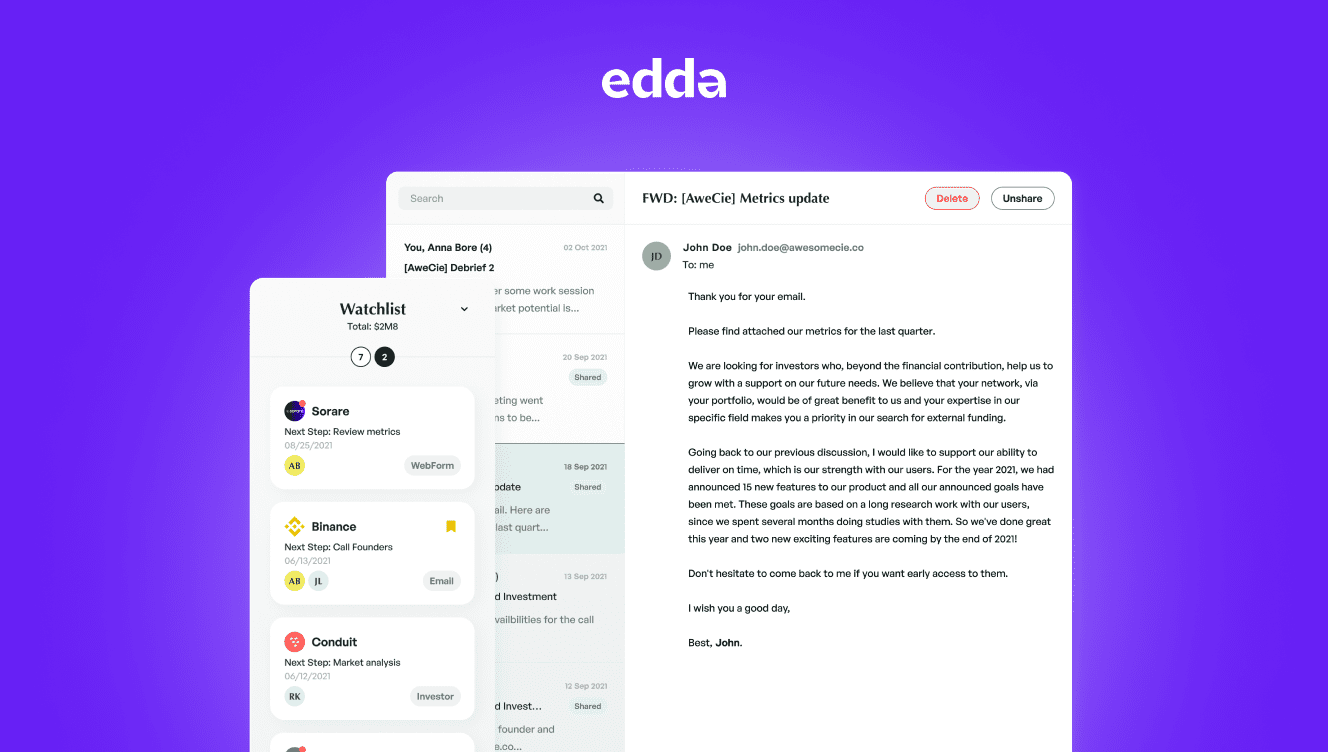

3) Gather the company data in the same place

Spreadsheets, dropbox and google drive are still very popular to share and store data. And they are not going to be replaced soon. But for the company data, you might want to have everything in the same place: sources, documents, metrics, emails, track who did what and when, todo’s, comments of the team members, news and articles. If you can’t visualize all this information in a single screenshot, your dealflow is not managed effectively.

Something else you might want to do at this stage is to share the company data with a trusted source. Since the company data is already organized, the export should be automated.

4) Measure to improve

I always say what you cannot measure, you cannot improve. Unless you are a business angel investing your money, you have to stay accountable for your LPs but also your team, companies and network. As an overview of your dealflow, I suggest to track the following:

- the sources that give you deals

- the average company time in the different stages of your dealflow

- the team performance (ratio accepted/rejected for each member)

5) Skip any activity that is low-value & time-consuming

If I ask an investor how long it takes to edit an investor note with the profile of a company, I usually get answers varying between 1-6 hours. Usually there is a lack of adrenaline when performing this redundant task. Combined with the procrastinator paradox, the truth is this task can even take several days and analysts are often late delivering it. If the task is really necessary, find out if there is a way to automate it. If not, just skip it.

Of course digital tools and a clear process are major factors in gaining efficiency and escaping redundant tasks. But maybe the best way to get “good dealflow” is to be a “good investor”. Value your team and value your network. I will end this article with a quote of Paul Graham, the founder of Y Combinator:

No matter how smart and nice you seem, insiders will be reluctant to send you referrals until you’ve proven yourself by doing a couple investments. Some smart, nice guys turn out to be flaky, high-maintenance investors. But once you prove yourself as a good investor, the deal flow, as they call it, will increase rapidly in both quality and quantity.

Thank you very much for reading. I would love to hear your thoughts on dealflow management. If you want to learn more about how Edda can help you manage the dealflow, write me a message. I would be happy to chat with you.

Or you can go ahead and book a demo with me and dig deeper into the possibilities with our dealflow management software.