After weeks or months of meeting, conducting due diligence, you have finally made an investment in a venture. However, now you can’t sit back and relax as the investment monitoring phase begins. One of the key success factors for a successful exit is to effectively monitor the progress of your portfolio companies. And choosing the right metrics for VCs monitoring is the key.

There are numerous metrics which can help you in monitoring process but it is essential to select the relevant ones. However, the relevant metrics for SaaS (Software-as-a-Service) companies won’t be the same as for the pharmaceutical company. Hence, our goal here is to depict which metrics are important for particular industries and how you can effectively track them with software venture capital tools.

VCs metrics for Marketplace Startups

For marketing place startups, one of the main metrics is the Gross Merchandise Value (GMV). It indicates the gross value of transacted goods and is calculated by the formula below:

GMV = Average value of an order x Number of transactions

However, one of the caveats associated with GMV is that it doesn’t take into consideration the value of discounts, returns, cancellations. Furthermore, it is not an indicator of revenue.

This can easily be seen in the chart example below which depicts the GMV of Alibaba from FY 2014-FY 2019 . In FY 2019 it was approximately CNY 5727 billion, while at the same time the revenue for entire Alibaba group stood at CNY 376.8 billion

Take rate or Rake- refers to the percentage of sales and commission a company earns on its sales. For instance, Airbnb charges 3% from the hosts and a variable service fee from the guests which is somewhere around 11% but it decreases as the cost of booking goes up. Similarly this metric is important for payment processing companies as well.

The figure below shows the rake of some major e-commerce marketplaces:

SaaS Companies (B2B)

Product market fit

The first step to measuring performance of a B2B SaaS company is to assess the product market fit. This can be done by looking at the Annual Recurring Revenue or ARR and the cash burn rate. If a SaaS startup doesn’t have a product market fit then it will be burning more cash than its ARR. In such cases, the company is spending too much on acquiring new customers who are in turn leaving the product. As a result, the ARR is low. In a nutshell, the lack of product market fit is an indicator of unsustainable growth prospects.

ARR Calculation

In the most simple way, ARR = Monthly Recurring Revenue (MRR) x 12

However, the customer must sign up for a yearly subscription contract. Below I am mentioning some more cases to calculate ARR:

Growth prospects

After looking at product market fit, the next avenue to evaluate is the growth prospects. Typically for B2B SaaS companies, one of the growth benchmarks is T2D3 which translates to Triple, Triple, Double, Double, Double. This means that SaaS companies in Series A-B phase must show at least 3x growth year over year for three consecutive years and then show at least 2x growth.

The figure below shows T2D3 path of some prominent SaaS companies:

Sales efficiency VCs metrics

One of the most popular VCs metrics for measuring sales efficiency of SaaS companies is the CAC (Customer-Acquisition-Cost) payback period. It shows the amount of time it takes a company to recover the cost it paid to acquire a customer.

VCs Metrics for SaaS Companies (B2C)

For SaaS B2C companies, the top metrics to look at are: Customer Chrun Rate, Revenue Chrun Rate, Customer Lifetime Value and Leads to Customer rate.

To start with, the Customer Churn Rate measures the number of customers a company has lost over a specified period of time.

Furthermore it is very important to calculate the Revenue Churn Rate because different customers can have different revenue weight-age. For example, losing five customers who pay $5000/year is less disastrous than losing a single customer that pays $45,000/year.

In addition, the Customer Lifetime Value denotes the average amount of money a customer pays during the whole engagement period with your company. It is calculated by finding the customer lifetime rate followed by average revenue per account.

Finally, the Leads to Customer Rate depicts the percentage of leads that were converted to customers.

VCs Metrics for Pharmaceutical Startups

As aforementioned, different industries will require different metrics for performance assessment. Hence, here we will discuss the relevant VCs Metrics for the pharmaceutical industry.

In order to show a strong standing the company must have a large number of discovered molecules and a significant number undergoing clinical trials.

Furthermore, an extremely important metrics is the R&D Spending. This metric is calculated by looking at the total amount of funds spent on R&D initiatives and comparing it to the amount spent on completing the development of products in the end cycle. Therefore, a small R&D spending is an indicator of lack of innovation and reluctance to adopt new technology.

In addition, Investment to IP ratio will depict how successfully the company is utilizing its R&D efforts to get more Intellectual Property (IP). The higher the number of IPs the better.

Moreover, the number of partnerships with other pharma companies is yet another sign of growth and credibility.

Finally, the Team Structure, or the number of specialists in each section is a very important indicator. Typically the team should have the following structure: 33% biochemistry specialists, 33% AI specialists, 33% investor relations and business development. As a best practice, the number of biochemistry specialists should not be less than 10.

How to track all these metrics?

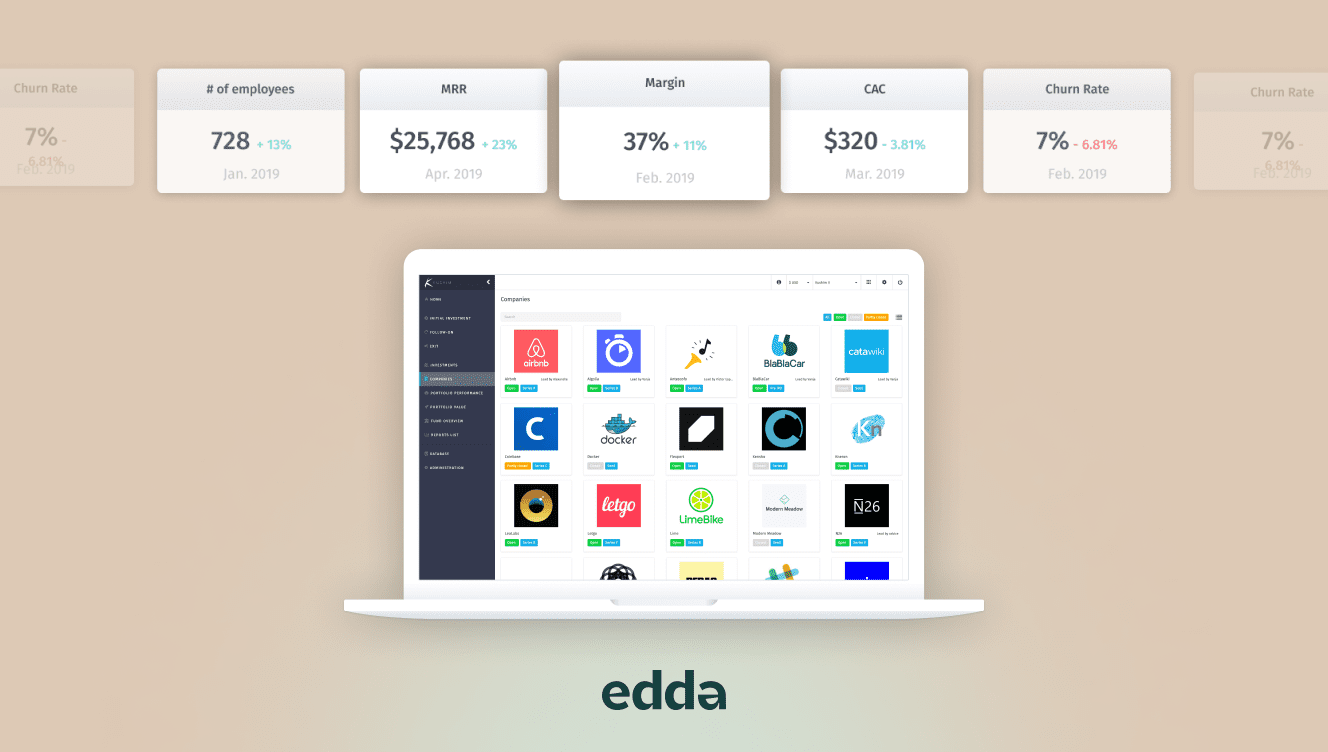

Evidently, there are countless metrics for tracking the performance of the portfolio companies. However, the burning question here is, how do you keep track of all the relevant metrics? And the answer is the Edda Management Suite which fetches you the most user friendly solution.

Clean, Precise and User Friendly

The “Companies” section of Edda’s Management Suite illustrates all companies in your portfolio in a precise and user friendly way. It also provides a quick search option.

One size CAN fit all

With a click you can open the company page which contains its details along with the section for captable and metrics. By default you have 60 different metrics which are well organized and categorized. Some of the categories include: Financial performance, HR, Market, Marketing, Operational Performance and Company.

You can select the metrics which are relevant to you and also create new metrics.

Stay Updated

With venture capital management software you can grant access to your portfolio company’s page for the officials of that particular company. In addition, with one click you can send an email to the company representatives to ask them to metrics updates. You can also export company details including the metrics to PDF using the Export button.

Finally, besides the metrics, the Edda Management Suite can do a lot more of the heavy lifting for you. Want to know how it can help you measure the performance of your entire fund or funds?

That’s all for this post! If you are interested, we have compiled a list of 200+ metrics for SaaS, Pharmaceutical, Social Impact, Real Estate and many more industries.

Click here to learn more about measuring the performance of your fund and contact us for a demo of Edda’s venture capital portfolio management software.